Basics of the university budget

What goes into the UBC budget

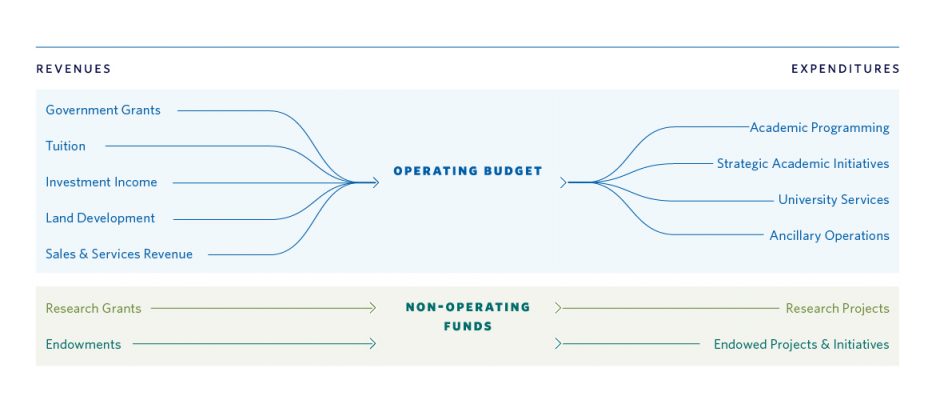

The university’s budget is made up of 2 parts:

- Operating Budget

- Non-Operating Funds

1. Operating budget

The operating budget, which includes your tuition, covers the core academic operations of the university, investments in new programs and services, and resources required to maintain current operations.

2. Non-operating funds

Non-operating funds can only be used towards specific projects and initiatives such as research, capital (i.e. buildings and infrastructure) and endowment initiatives.

What makes up the operating budget?

The operating budget is made up of revenues and expenses to support core academic operations.

The university’s operating revenue

Student tuition is 1 of 4 major sources of revenue for the university. The other three are government grants, sales and services, and investment income.

- Government grants

UBC receives provincial and federal government funding for domestic undergraduate courses, research, and some graduate-level teaching. - Student tuition

Fees are collected from both domestic and international students. - Sales and services

Revenue is collected from lease income and fee-for-service activities across both campuses. Ancillary services including student housing and food services are expected to be financially self-sustaining. - Investment income and land development

Income is earned on cash and operating investments as well as internal loans covering large scale buildings, infrastructure and technology projects.

| Operating revenue (in $ millions) | Actuals FY2022 | Actuals FY2023 | Approved Budget FY2024 |

|---|---|---|---|

| Tuition – Domestic | 385 | 393 | 395 |

| Tuition – International | 596 | 611 | 661 |

| Government grants & contracts | 777 | 862 | 989 |

| Sales and Services – Ancilliary | 222 | 291 | 312 |

| Sales and Services – Other | 281 | 318 | 326 |

| Other income | 581 | 683 | 343 |

| Operating Revenues | 2,844 | 3,158 | 3,027 |

The university’s operating expenses

A significant portion of the university’s expenses cover recruiting and employing faculty and staff. Many faculties receive funding directly from non-core activities outside of the operating budget. These funds are directly by faculties to support their operations.

- Salaries and benefits

Faculty and staff are committed to teaching and providing supports to students as well as other businesses and general operation supports. - Operational supplies and expenses

Ongoing cost of running university services. - Scholarships, fellowships, and bursaries

UBC offers financial supports for domestic and international students. - Other operating expenses

Covers capital expenses and transfers that support initiatives across the university.

| Operating expenses (in $ millions) | Actuals FY2022 | Actuals FY2023 | Approved Budget FY2024 |

|---|---|---|---|

| Benefits | 239 | 268 | 287 |

| Salaries | 1,266 | 1,358 | 1,526 |

| Operational costs | 511 | 612 | 656 |

| Scholarships, fellowships, and bursaries | 127 | 115 | 136 |

| Other | 613 | 790 | 422 |

| Operating Expenses | 2,757 | 3,142 | 3,027 |

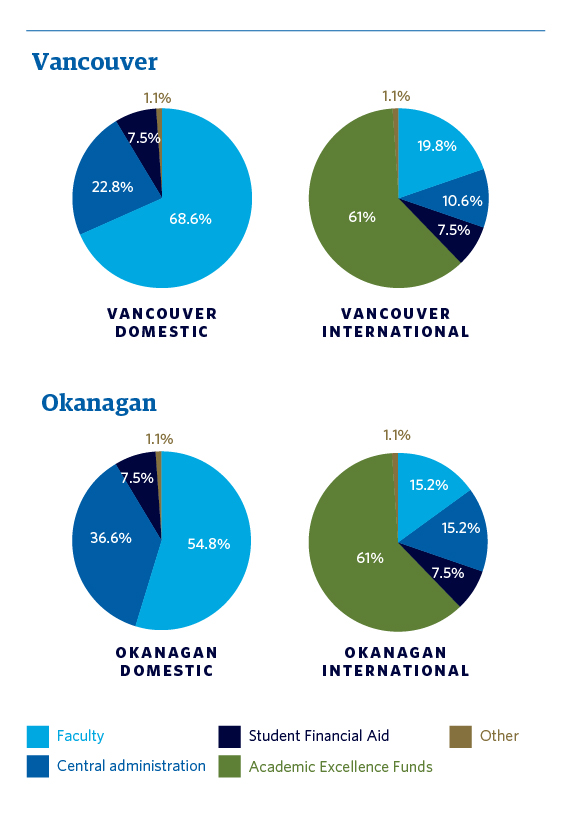

Where your tuition goes

Tuition fees support UBC faculties, central administration, and student financial aid. In addition, a portion of tuition from international students goes towards the UBC Excellence Funds on both the Vancouver and Okanagan campuses.

- Faculty and central administration

UBC uses a decentralized budget model, which means that faculties and administrative units are responsible for balancing budgets within their specific areas. - Student financial aid

A set portion of all tuition goes back to students as financial aid in the form of bursaries, scholarships, and awards. - Excellence Funds

Strategic investments to attract the best faculty and students, support world-changing research, and deliver an exceptional learning experience. Some of this is re-invested as student financial aid. - Other

A small portion of tuition is allocated to cover financial transaction fees and potential bad debts.

Budget considerations

UBC continues to face challenges in escalating cost pressures, some of which continue to be exacerbated by the COVID-19 pandemic. While inflation has decreased significantly from the prior year, it continues to be above the Bank of Canada target rate of 2% and is a significant cost driver as mentioned in the section below.

Operational efficiencies

UBC is introducing new initiatives for efficient and effective service delivery operational excellence. This work includes a continued focus on transitioning our core Finance, Human Resources, and student information technology systems to a new platform. Additionally, processes across the university continue to be reviewed to determine where automation and value-added improvements can be implemented.

Internal cost pressures

Increases to the university’s budget are limited by incremental funding, which is outpaced by increases to faculty and staff salaries. These are established by collective agreements and contractual obligations to appropriately compensate university employees. Additionally, high levels of inflation are impacting non-labour costs in both faculty and administrative units causing further cost pressures to the university.

Inflationary pressures

The University is facing financial pressures as costs continue to rise while revenue remains constrained. The increases in equipment and material costs have placed significant pressure on non-labour expenses, including utilities, consumables, and equipment.